Calculate salary per hour after tax

Your hourly wage or annual salary cant give a perfect indication of. Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator.

3 Ways To Calculate Your Hourly Rate Wikihow

For instance an increase of.

. Unlike most other states in the US Pennsylvania does not. To use the tax calculator enter your annual salary or the one you would like in the salary box above. In Ontario and Alberta thats 15 an hour 600 a week 2600 a.

For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a full-time schedule of 40 hours a week. I was trying to find out my net pay after. How do I calculate salary to hourly wage.

This number is based on the. This marginal tax rate means that your immediate additional income will be taxed at this rate. New Zealands Best PAYE Calculator.

Some states follow the federal tax. The Australian salary calculator for 202223 Hourly Tax Calculations. Note that although this will result in slightly smaller paychecks each pay period your tax bill may turn into a refund come tax time.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Companies can back a salary into an hourly wage. The Indian Tax Calculator calculates tax and salary deductions with detailed tax calculations and explanations based on the latest Indian tax rates for.

Just select your province enter your gross salary choose at what frequency youre being paid yearly. Enter your Hourly salary and click calculate. You can personalise this tax illustration by choosing advanced and altering.

On the high end of the minimum wage British Columbia pays 1565 an hour 626 a week 2713 a month and 32552 a year. Your average tax rate is 270 and your marginal tax rate is 353. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE.

This places US on the 4th place out of 72 countries in the. You will have to pay about 21 18092 of your Yearly salary in taxes. Multiply the hourly wage by the number.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Your average tax rate is 217 and your marginal tax rate is 360.

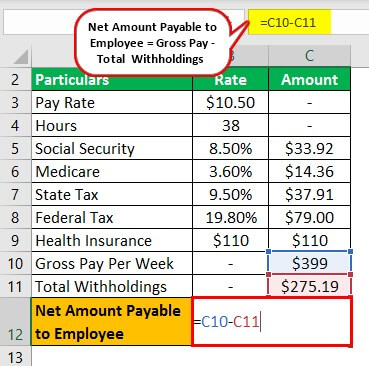

The Australian salary calculator for 202223 Hourly Tax Calculations. A Yearly salary of 85000 is 66908 after tax in Australia for a resident full year. Your employer withholds a 62 Social Security tax and a.

Calculate your take home pay from hourly wage or salary. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Your salary - Superannuation is paid additionally by employer.

Take home pay 661k. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For instance an increase of.

About the Indian Tax Calculator.

4 Ways To Calculate Annual Salary Wikihow

Hourly To Salary What Is My Annual Income

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

17 An Hour Is How Much A Year Can I Live On It Money Bliss

4 Ways To Calculate Annual Salary Wikihow

Hourly To Salary Calculator

What Is Annual Income How To Calculate Your Salary

Payroll Formula Step By Step Calculation With Examples

Salary Formula Calculate Salary Calculator Excel Template

4 Ways To Calculate Annual Salary Wikihow

Hourly To Salary Calculator Convert Your Wages Indeed Com

Annual Income Calculator

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator

4 Ways To Calculate Annual Salary Wikihow

Salary Formula Calculate Salary Calculator Excel Template